Inflation: Mission Accomplished?

- Marco Annunziata

- Aug 13, 2022

- 4 min read

I find it kind of funny how “zero inflation” has come to be hailed as a blessing; not that long ago it was feared as the brink of deflation, that terrifying economic bogeyman.

Don’t get me wrong: it was a relief to see July consumer prices unchanged from June, with the year-on-year inflation rate declining to 8.5% from June’s 9.1%. The improvement, driven by a 4.6% decline in energy prices, was stronger than expected. Core inflation, which excludes energy and food prices, also came in lower than expected at 5.9%. Medium term inflation expectations came down in the latest New York Fed survey, though they were slightly up in the Michigan survey.

This is all good news. If commodities stop adding fuel to the inflation fire, the Fed will have an easier time restoring price stability, and families will preserve more of their purchasing power.

The key question though is: once the smoke of the energy shock clears, what rate of inflation are we looking at? Since the July overall price level was unchanged even though energy prices fell, it means other prices kept increasing at a solid pace. Food prices rose 1.1% on the month – that’s an annualized pace of 14%.

Food and energy prices tend to be more volatile, so core inflation is a better gauge of long-term price trends. Core CPI rose 0.3% on the month, an annualized pace of close to 4%. Various measures of underlying inflation (like those calculated by the New York Fed and the Atlanta Fed) are still running at 5-6%.

Bottomline: even without adverse supply shocks we probably have inflation running at more than twice the Fed’s 2% target. The Fed’s job is definitely not done yet.

My friend and former colleague JP Soltesz raised another important question in a LinkedIn comment to my last blog: the high inflation rates of the past twelve months have generated much hand-wringing, but we know inflation had undershot in past years; so are price levels now about where they would have been if inflation had been running at 2% all along?

In its new monetary policy framework launched in August 2020, the Fed promised to let inflation run above 2% for long enough to make up for previous undershoots. In other words, it said it would aim to achieve 2% inflation on average.

So, mission accomplished?

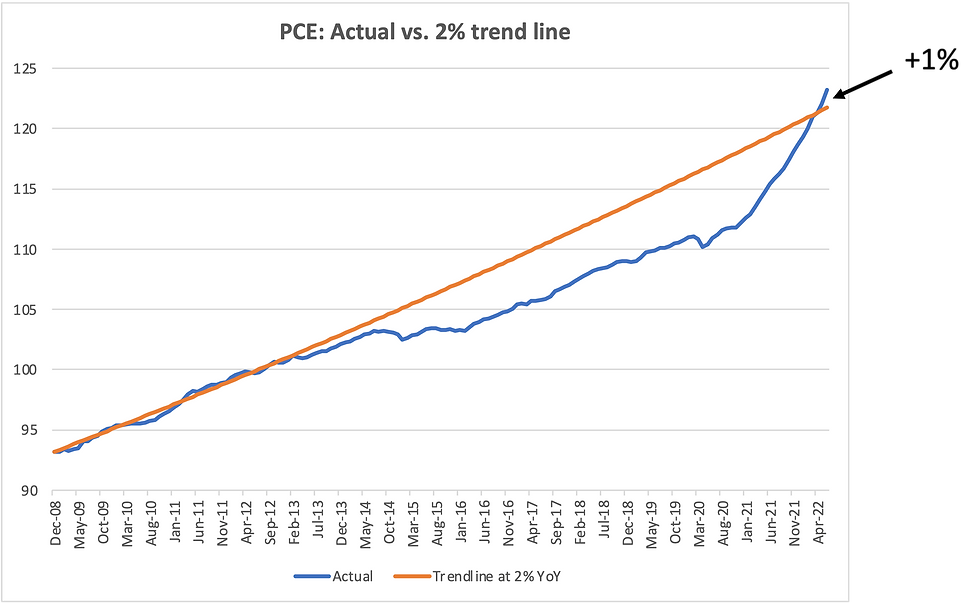

It depends. If we take the Fed’s favorite inflation rate, the Personal Consumption Expenditure deflator (PCE), the answer is yes. The Fed never specified over what time horizon inflation should average 2%. Let’s take as a starting point the beginning of 2009, when the global financial crisis brought us the specter of deflation (I am being generous to the Fed here, because inflation ran consistently above target during 2000-08). PCE price levels are now about 1% higher than they would have been if PCE inflation had been running at 2% per year since 2009. On this metric, mission accomplished.

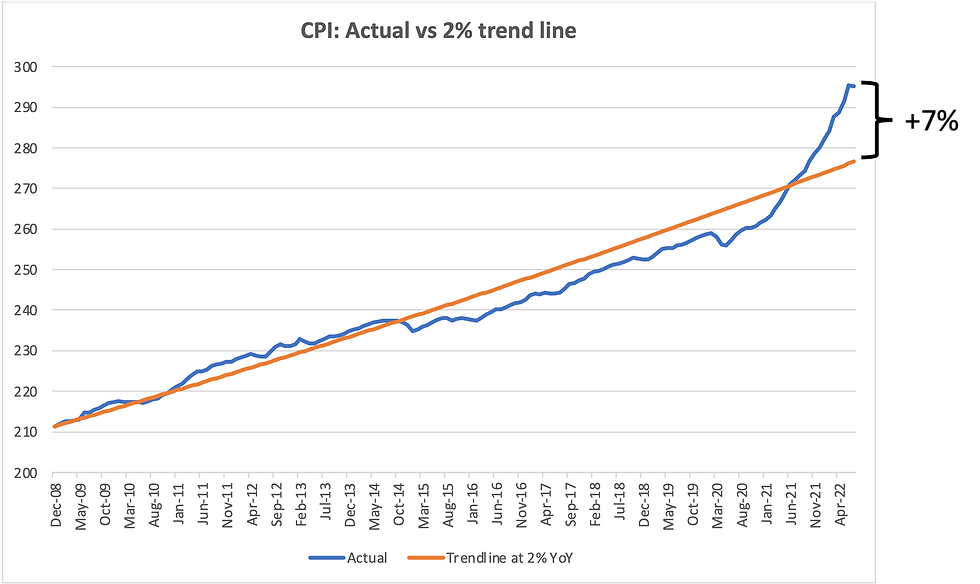

CPI prices, however, are 7% higher than if CPI inflation had been running at 2% all along. That’s a significant overshoot – and a big chunk out of households’ purchasing power.

That’s quite a difference. So which one should it be, CPI or PCE? There are two main differences between the two measures. One is technical: the PCE adjusts more rapidly to take into account changes in what people actually buy. The other relates to coverage: for example CPI measures out of pocket medical expenses, whereas PCE also captures health expenditures covered by employers, Medicaid and Medicare; PCE gives a much lower weight to housing costs (23% versus 42% in CPI). If you are interested you can find more details in this Brookings piece.

One can make a solid argument in favor of PCE. However, (1) the Federal government relies mostly on CPI, for example to inflation-adjust Social Security benefits and income tax brackets; (2) most other countries use CPI, so international comparisons are based on CPI; and (3) the public debate on inflation centers on CPI. With inflation running so high, and given that CPI inflation tends to run consistently higher than PCE, it becomes awkward to anchor monetary policy on PCE.

I’ll conclude with a mischievous question. The Fed’s 2% average inflation target sounds symmetric. So, if inflation keeps overshooting the 2% trend, should the Fed then force a new period of below-2% inflation to make up for the overshoot? I would strongly suggest not, and I doubt the Fed would consider it. But this shows that the Fed’s new policy framework was not just poorly timed but also poorly designed. Poorly timed because it made the Fed too slow to react as inflation accelerated; Poorly designed because it could increase volatility in both monetary policy and economic outcomes. I would prefer a humbler, statistical interpretation of an average inflation target: try to steer inflation towards 2%, recognizing that sometimes you will undershoot and sometimes you will overshoot. Trying to hit a precise medium-term price level target is self-defeating.

Comments